Now, most people do not know about the cryptocurrency market. Someone hears about bitcoin, but does not want to understand this alone. Sometimes knowledge comes from people who themselves do not really understand what it is and send information in a negative background with irony tones. If we find such a person, do not blame them, because they do not come to understand the simple fact that the world's finances are changing. One of the first banks to realize when in 2015 a group of 40 largest banks in the world organized a consortium to learn blockchain technology.

Long ago, in ancient times the trades of our ancestors had not been what we see today. At that time there was no or no currency in the entire archipelago. Their merchandise is not traded using money as a medium of exchange, but exchanging goods between them.

The way of trading that was in effect at that time was by barter system, ie the merchandise they brought was interchangeable in accordance with the needs and needs of each. For example: There are residents who dwell on the slopes of the mountain will barter with the inhabitants of the coast. A more complicated example: if our ancestors from Sumatra needed rice and other food then they sailed to Java bringing the results earth in the area of gold or silver to be traded or exchanged. Similarly, those from the island of Maluku bring spices to the island of Sumatra Sumatra then they need gold or silver, then they also exchange the goods they carry with the required goods.

At that time the population did not know the currency as it is now. People make direct exchanges of the goods they need with the excessive stuff they have.

But now the trading system has changed, who does not keep up with the times then they will be left behind, imagine you can now buy goods and sell goods with just one click. This is where the technological revolution of blockchain and cryptocurrency technology evolves .

They understand that changes in the financial world will not prevent and decide if you do not lead the way, then at least do not stay on the sidelines of understanding. there have been many test projects in the banking sector, based on blockchain technology. There are also many cryptocurrency trading exchanges. Engaging in stock market speculation, and one long-term investment in Tokens. This investment is now open to everyone, regardless of the level of technical training and knowledge of the features of the token. I often write in previous reports that the cryptocurrency world is beginning to gradually move into the real world. Information, finance, communications, trade and game services, etc.

The redesigned blockchain technology how we do our business today has made life a lot easier and more efficient. Technology has been adopted by key industry days such as financial sector, health sector, music industry, insurance industry and many others who get on board. This technology became popular because it increased efficiency, reduced costs, increased transparency and safe and decentralized.

With this I am returning to the topic and writing about the ModulTrade project that changed my view of the world of commerce and cryptocurrency.

WHAT IS MODULTRADE?

ModulTrade is a decentralized platform that brings together buyers and sellers around the world. ModuleTrade is suitable for solving common problems faced by cross-country merchants and buyers; expensive shipping costs and distrust. This project provides support to small entrepreneurs who want to grow their business, as well as to abandon global buying and selling habits that determine buyer and buyer priorities on a large scale. ModuleTrade is implemented using blockchain technology.

The ModulTrade system operates gradually:

Sellers and buyers are traded to negotiate. After the price agreement, both parties switch to SmartContract, where buyers transfer funds to the system.

The seller sends the goods to the address specified by the buyer, while the SmartContract system blocks the agreement of both parties, then tracks the delivery of the goods from the seller.

When the goods ordered by the buyer have arrived and confirmed, the SmartContract system will automatically release the money to be sent to the seller. It was a successful transaction.

A secure payment mechanism contributes to increased sales, based on new customer service: credit, crypto payment and end-to-end trading services.

ModulTrade is an easy-to-use trading platform, based on block-break, created as a base for small and medium enterprises (UMKM).

With the ModulTrade platform, all transactions will be 100% efficient, fast and reliable. The project team offers full support to traders in transactions, with all segments of the trade. You can count on it for logistics, payments, insurance, financing, taxes, accounting, etc.

ModulTrade is one of the first block projects in the financial trading sector, which will go on sale, under a new concept of digital commerce. The smart-based system based ModulTrade system will provide comprehensive services, minimum traditional fees and support for cross-border trade in emerging markets.

HOW TO WORK AND PURPOSE OF MODULTRADE.

ModulTrade aims to democratize global commerce by using blockchain technology. Specifically, ModulTrade wants to create a blockchain platform where 400 million micro, small and medium enterprises (MSMEs) can meet each other, enter into efficient trading agreements, and get help with trade-related services at cost-effective.

Today, many small businesses avoid international trade due to logistics costs. It is not always appropriate for small businesses to partner with businesses around the world. Many small businesses do not even know where to start - even if there is a market, the market may be underutilized .

With that in mind, ModulTrade plans to use two major blockchain technologies to create "ModuleTrade Value Ecosystem" (MVE):

- A smart contract platform that mimics traditional trade finance instruments (such as letter of credit and bank guarantees) while allowing companies to build trust with trade agreements .

- MTRC, a token based on Ethereum ERC20, which will allow frictionless trading with a borderless currency; the token will be accessible to any business with smartphones, enabling small businesses to trade in real-time, globally, and cost effectively .

ModulTrade aims to combine the development of new crypto-developed ecosystems, helping the platform be "one of the few pioneers that can improve the trade finance industry by connecting millions of companies" in an efficient, trustworthy and easy way .

MTRc Token

The Crypto Token ModuleTrade (MTRc), an ERC-20 token released on Ethereal, is a key element of the new multi module B2B platform from ModulTrade, allowing users to connect to the network.

ModulTrade platform and its ecosystem and for transaction effects.MTRc will be the main item to be distributed only during pre-sale and sale sales Tokens campaign. Therefore, the number of MTRC tokens will be set from the end of November 2017 to be guaranteed by the smart contract token.

Demand for MTRc is expected to be boosted by MVE and by the growth of theTrade module. ModuleTrade solutions are technologically measurable. The long-term scalability of the platform due to the current

Ethereal technological constraints is a problem that can be addressed in some way that is feasible, safe and realistic.

Ethereal technological constraints is a problem that can be addressed in some way that is feasible, safe and realistic.

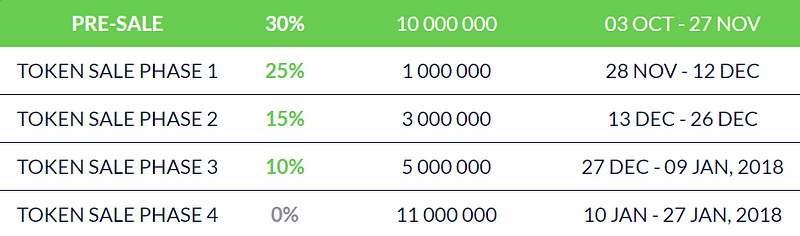

Pre-Sales

Token pre-sale and sale sales in 2017.

- up to 10,000,000 tokens will be distributed during Pre-sale.

- 30,000,000 tokens will be distributed during Token Sales.

No more MTRC distribution will be performed after Token Sale expires.

The MTRC price is set as follows:

Pre-sale price: 1MTRc = 1ETH / 700The sale price of Token: not less than 1MTRc = 1ETH / 700 and specified 2 weeks before main Token Sale.

ROADMAP

TEAM

- Evgeny Kaplin - Co-founder /

CEO.

17+ in the world of International Trade and Business Banking with strategic consulting experience. Successfully launched and runs a global trading platform at one of the top banks in Europe. McKinsey, Skerbank, Cargill, Gazprom.

- Jean Chaanine - Co-founder /

COO.

25 years in senior management technology at the operational and strategic level in the multicore and banking services sector. SODEXO, Credit Agricole CIB, Société Générale, Banque de France, Saint Gobain, Ciments Français .

- Karthikeyan Kaliyaperumal - Co-founder / CTO.

20+ years of experience in US business Technology Strategy and Product Management in global wealth 500 companies build supply chain, financial and marketing platform for Nielsen, CBOE, Acxiom etc.

- Fedor Sapronov - Co-founder / Business Development.

17+ years in Corporate banking and investment with deep experience in financial loans, Project & Structured. Executive positions at leading banking institutions, Sberbank, Alfa-Bank, Gazprombank.

- Marco Rosso - Co-founder /

Product Development.

18+ years in EMEA financial services with deep risk management and structured financial experience. Position as advisor to Ernst & Young, Reuters and Banking Institutions.

- Alexei Katrich - Co-founder /

Product development and marketing.

25+ years of IT experience and Professional banking, in-depth knowledge of Banking transformation, Product development, information security - exclusive role in IMB. UNISYS, ING, Intensa Sanpaolo, Deutsche Bank, Sberbank.

- Vitaly Pykhtin - Market product development leads.

15+ years experience in Banking industry. Launch and Management of successful retail and wholesale loan platform at BNP Paribas. Breakthrough international market in Banking transactions.

- Dmitry Shipilov - Product /

technical development.

12+ years in the development of IT solutions, architecture, technology consulting and business analysis .

- Artem Radchenko - Product Development /

Product Designer .

12+ years experience in various areas of Product Design, UX design for various markets and electronic services.

- Olya Kolomoets - Product Development Project Manager.

Highly skilled project and program managers with experience leading the project in multiple industries.

- Alexey Kosinski - Development of Blockchain developer products.

Experienced full-stack developers with a focus on building new products and decentralized systems supported by Blockchain technology.

- Volodymyr Zinchenko - Development of a full-stack Developer product.

Experienced software engineer with full-stack knowledge base. Lead-oriented technical quality, clean code enthusiasts are able to provide complex solutions with maximum efficiency.

ADVISORS

- Bernard Lietaer

Bernard, author of The Future of Money is an international expert in the design and application of currency systems. He co-designs and implements a convergence mechanism to the European single currency system (Euro) and serves as president of the Electronic Payment System .

- Dmitry Lazarichev.

With 16 years of experience, Dmitry is a financial professional and brings entrepreneurial talent to the board of directors. Dimitry founded Wirex, one of the first crypto mobile banks, now supported by the SBI Group. Over the past three years, he has been heavily involved in blockchain technology and the creation of digital assets. After a career in financial consulting, he launched his first UK-based venture in commodity trading in 2012. The Executive MBA at London Cass Business School.

- Richard Schwenke

Richard is Managing Director and Co-founder of Contorion GmbH, building and developing a successful B2B e-commerce business. Over the years, the Germans have acquired the skills and expertise to provide strategic and applied solutions. Richard is highly respected among his friends and as a reputable adviser

- Andrea Costantini

Andrea currently operates as Vice President of Agrati Group and CFO. The Italians spent five years working as Senior Auditor for one of the top four, KPMG and also Arthur Andersen in Milan, Italy. He has also developed his experience in major brands including Coca-Cola, where he works as Principal International Auditor. Andrea brings a solid global understanding of the trade finance sector.

- Richard Watts

Richard has experience in all areas of shipping, trade, insurance, finance and legal affairs. As Founder and Managing Director of HR Maritime based in Geneva, he navigates the business with a strategic approach to international and trade in the shipping industry. In his 17-year career, he has worked at Addax & Oryx Group's Rice Trading Company and Ascot Commodities NV. Richard became a member of the ICS (Institute of Chartered Shipbrokers) in 2010.

- Andrea Monaco

Andrea is Chief Operation Officer at VI.BE.MAC. SpA, with extensive experience in capital management, risk analysis, governance and regulation, works in Citigroup, Deutsche Bank, Sony and GlaxoSmithKline. His career provided a range of business skills in finance and technology and he successfully completed the Fintech Future Commerce course at the Massachusetts Institute of Technology.

- Angelica Lips da Cruz

Executives, leaders and entrepreneurs in digital financial solutions and financial ecosystems in the ALDC Partnership who lead the development of the New Financial Algorithm rating system. Former head of trade financing and supply chain financing at SEB. Previous Sales Director and Board Member at RCI Banque Nordic Countries and VP at Citibank London PLC, Investment Banking, also leads Europe Credit Risk management and European CEEMEA reporting unit.

- Sebastiano Picone

The Italian Commercial Director of Moneyfarm. During his experience at Moneyfarm, he contributed to building a CRM and Sales team and service model to manage thousands of customers in two countries. Over the years he gained skills and expertise also in online and offline acquisitions in the financial sector. Sebastiano earned the title CFA in 2012.

- Valentin Preobrazhensky

As CEO of Latoken and founder of Zalogo startup, Valentin joins our board with extensive experience and knowledge in the finance industry. After studying at the honorable institutions of Harvard and Stanford, Valentin then built his career at IHS, CERA, VTB and Sberbank. He also succeeded in realizing the role of equity portfolio manager at Avega Capital and Marcuard Spectrum.

- Richard Ramos

General Manager of Insight Technology in France. 25 years in business and senior management technology in international software, hardware and service companies. Extensive experience in multi-country business development directly and indirectly. Executive positions in Atos, HP, Nokia, Apple, SMART .

- Kelvin Tan

Kelvin is co-founder and Chief Investment Officer of GTR Ventures, based in Singapore. He has extensive experience in serving as Deputy Director of the Monetary Authority of Singapore and Senior Investment Officer at the International Finance Corporation. In addition he manages the highest corporate and government relationships as Vice Director of the Ministry of Commerce and Industry of Singapore.

- Daniele Azzaro

15+ years experience in strategy consulting for global Financial Institutions such as Barclays, Lloyds and The Royal Bank of Scotland. An expert in preventing the risks of financial crime and digital innovation, he has designed and implemented innovative RegTech solutions that lead the market and act as advisor to other successful ICOs. He has an MBA, is a finalist of the Fintech Future Commerce MIT course, and is a member of the Association of Certified Money Laundering Specialists .

- Christian-Laurent Bonte

Christian spent the last 15 years between Asia and the Middle East in Management Consulting for Investment Bank Group Natixis and then Corporate Finance which focuses on Technology. Based in Singapore and earlier in Hong Kong, he was involved in the Fintech ecosystem.

For more information, visit us:

Username: KidsJamanNow

My Bitcointalk Profile Link: https://bitcointalk.org/index.php?action=profile;u=1308879