This review is designed to give interested parties a quick precis of the FarmaTrust project and a medium-to-longterm look at what benefits may be returned to token holders.

FarmaTrust ICO: The Basics

Token ID: FTT (ERC20 to be upgraded to ERC223 at a later date)

ICO Soft cap of US$10 million | Hard cap of US$45 million

Dates:

Private Sale (already completed - US$4 million raised)

Pre-TDE: 15 February - 15 March 2018

TDE: From 15 March - for 4 weeks (or earlier, if 600 million FTT sold)

Private Sale (already completed - US$4 million raised)

Pre-TDE: 15 February - 15 March 2018

TDE: From 15 March - for 4 weeks (or earlier, if 600 million FTT sold)

Minimum contribution: US$80 | Currently no individual cap

Tokens available: 600 million FTT for sale (out of a total of 1 billion FTT)

1 FTT = US$0.101091 (20% discount for first 200 million FTT or until end of Pre-TDE, whichever occurs first)

Unsold tokens will be locked in for a minimum of 3 years.

USA & Singapore residents are unable to take part in the ICO.

The FarmaTrust team are based in the United Kingdom and comprise a diverse and skills-complementing group of 12 individuals, who are further supported by another 8 knowledgeable and influential advisors.

FarmaTrust Goal.

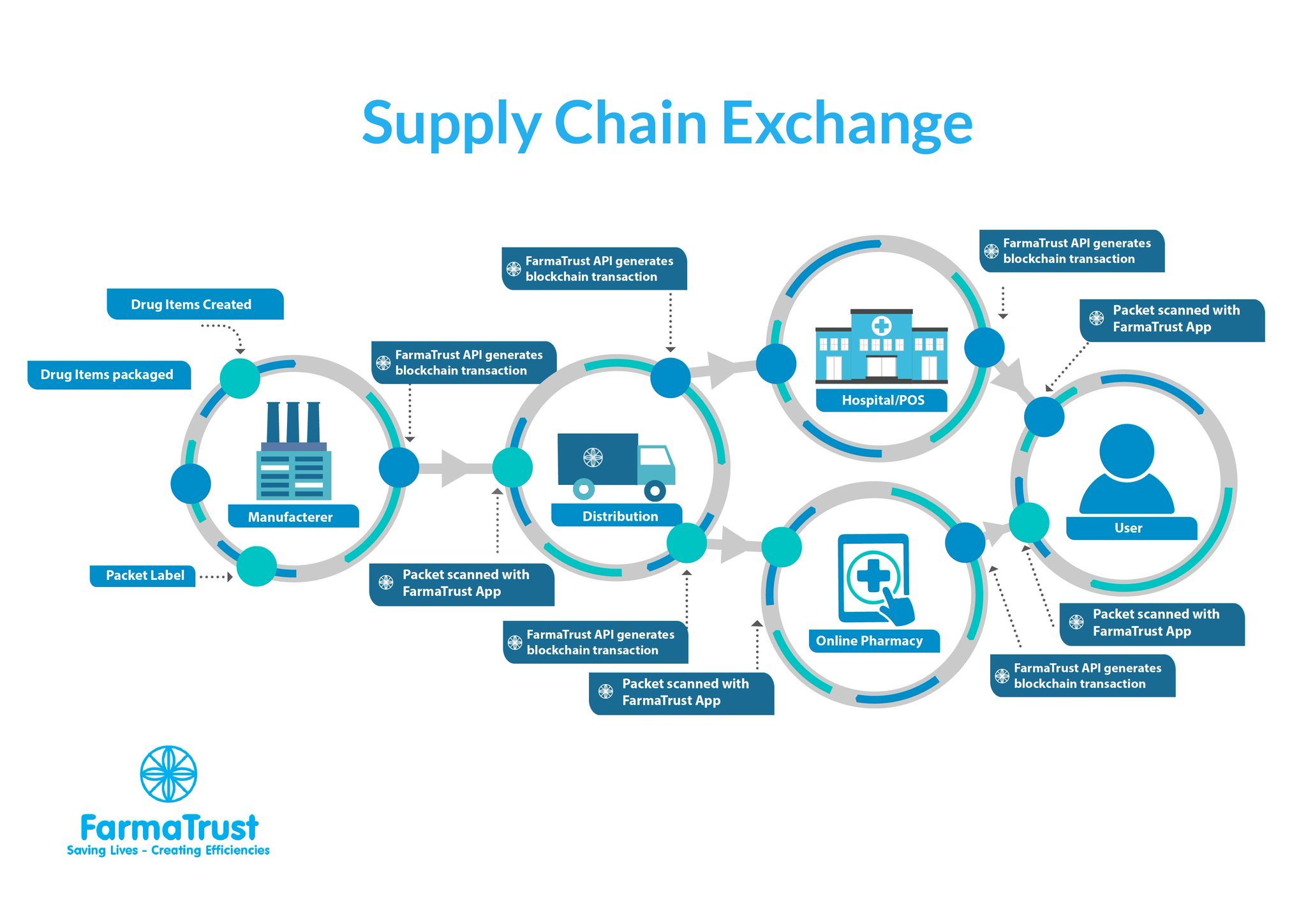

To provide a platform that enables track and trace of pharmaceutical products, thereby combatting the proliferation of counterfeit drugs and allowing all supply chain participants to confirm the pedigree of a specific packet of medication, through the immutability of blockchain technology.

Perceived Product Benefits.

- saves lives by providing access to previously locked-in user data for R&D use.

- significantly reduces development costs by using exiting technology.

- because there’s no central database and a decentralised ledger, it provides infrastructure infallibility and incorruptible record integrity

- is widely adaptable - can be configured to whatever regulatory requirements are in place

- the system works anywhere there is a connection to the internet, either through landlines, 3G/4G/5G availability or through satellite technology - it is globally available.

Identified Product Risks.

- The biggest risk for FarmaTrust is the potential lack of adoption of their system by the pharmaceutical industry.

- Ethereum price fluctuation, specifically Gas price for utility token transfers, could also impact on system adoption.

FTT Token Functionality.

The Token design is based on a Holder-Utility token model.

FTT Tokens are Holder tokens that generate Utility tokens (uFTT) on a weekly basis. The supply of FTT tokens is fixed, with a maximum of 1 billion tokens; however, only a portion of the total supply will be initially liquid. FTT tokens are fungible and transferable, and there is no token creation, minting or mining after the Token Distribution Event (TDE).

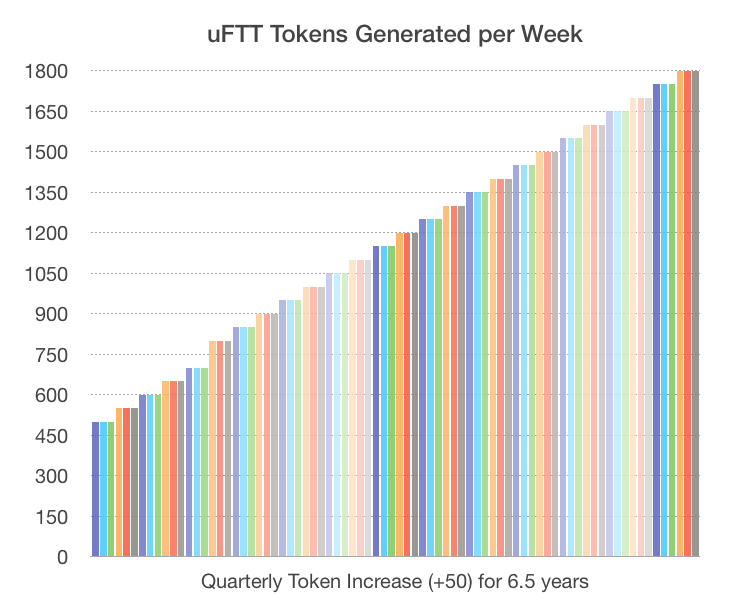

Each FTT token produces 500 uFTT tokens per week, increasing incrementally (quarterly) for 6.5 years, at which time they stop production until sold or transferred to another wallet.

It is envisaged that as time goes by and the popularity of the platform grows, the need for more tokens will necessitate a larger volume of uFTT tokens to be available at any given time, hence the quarterly incremental increase in uFTT tokens per FTT holder token.

The continual trading of FTT tokens privately on crypto exchanges will, in the longterm, create an overlap/offset of the 6.5 year uFTT token generation cycle.

The above table graphs the weekly uFTT token generation volume for each FTT Holder Token.

Example: If you hold 1000 FTT, their first week of production would result in the generation of 500,000 uFTT tokens. In their last week of production (in the last quarter of the 6.5 year cycle), those same 1000 FTT would produce 5,425,000 uFTT.

uFTT Tokens are required to track the various items and drug packets through the FarmaTrust platform as well as pay for tools and services provided by FarmaTrust.

uFTT tokens are burnt at the end of the route of its associated drug packet. Data created during the journey of each drug packet is stored on the blockchain and will be available for those that wish to verify it (eg. regulators).

Examination of the Token Use Case: Zoi.

FarmaTrust has developed a platform, codenamed Zoi, which is the basis of the functional Supply Chain Exchange (SCE) that underpins the entire enterprise. The Zoi platform:

- is a multifaceted interface, which can be used by all participants of the pharmaceutical supply chain, from manufacturers and distributors, through to hospitals, pharmacists and finally, consumers, to check the validity of each medicine packet.

- also allows for regulators to undertake necessary inspections via the extraction of relevant data.

- is software and hardware neutral, meaning it can be adapted to any current systems used within the supply chain or by regulators.

Minimum Viable Product (MVP)

FarmaTrust have a functioning demonstration model already available.

The FarmaTrust Roadmap lays out a development path to full production release in Q2 2019.

Potential Revenue Analysis (PRA).

Assumptions:

- There is a successful ICO.

- There is a broad acceptance and implementation of the Zoi platform within the pharmaceutical industry.

- This PRA uses a current value approximation for Ethereum of US$800 = 1 ETH.

- Each uFTT will have a market value of five thousandths of a cent (US$0.00005)

- Each yearly quarter contains 13 weeks

- There is a broad acceptance and implementation of the Zoi platform within the pharmaceutical industry.

- This PRA uses a current value approximation for Ethereum of US$800 = 1 ETH.

- Each uFTT will have a market value of five thousandths of a cent (US$0.00005)

- Each yearly quarter contains 13 weeks

If you were to buy 10,000 FTT, it would cost you approximately US$870.

In the first week that the platform goes live (Q2 2019), your 10,000 FTT would produce 5,000,000 uFTT.

At the above uFTT market price, the income from the sale of those 5,000,000 uFTT would be US$250.

When the first quarter finishes and the uFTT generation volume increases by 10%, you will have already generated and sold 60,000,000 uFTT for a total of US$1083.

Let’s move ahead to the final quarter (year 6.25 to 6.5 of the utility token generation cycle), when uFTT generation is 1800 per FTT per week: those 10,000 FTT would generate uFTT worth $900/week.

For the entire 6.5 year period:

- each FTT you own produces in excess of 393,000 uFTT

- your 10,000 FTT produce a revenue stream in excess of US$196,000

Estimated Cost of 10,000 FTT: US$870

Projected 6.5 yr total Revenue: US$196,000+

Projected 6.5 yr total Revenue: US$196,000+

At the end of the 6.5 year cycle, token generation stops until the FTT is sold or transferred. You can simply transfer your tokens to another wallet you own and the 6.5 year uFTT generation cycle starts all over again.

If we average out the revenue over the 6.5 years period, it is just over US$30,000/year (or US$3 per FTT Token per year)

As every FTT token has the potential to earn the same amount, when all 1 billion tokens are generating uFTT, the yearly average revenue for all FTT tokens would be approximately US$3 billion.

If we take a very reasonable EBITDA multiple of 8X, then the FarmaTrust Market Cap for 1 Billion FTT would be US$24 Billion, meaning each FTT would be valued at US$24, so your 10,000 FTT would have a market value of US$240,000.

Estimated Cost of 10,000 FTT: US$870

Estimated Market value after ~7 years: US$240,000

Estimated Market value after ~7 years: US$240,000

Many assumptions have been made in the above PRA. I am not a financial analyst and the above information should not be construed as financial advice and is not intended as financial advice. I am simply making assumptions and speculating, based on those assumptions. Always do your own research before investing in anything. The price of FTT tokens may be volatile once listed on any exchange, and purchasing cryptocurrencies can be a high risk activity.

FarmaTrust make it quite clear in their Whitepaper that there are no guaranteed returns. Proceeds of the FTT TDE will be used to fund FarmaTrust operations, including development phases as set out in the roadmap. Participation in the FarmaTrust token generation event means you are sponsoring the development of the FarmaTrust exchange platform. FarmaTrust does not and cannot promise any guaranteed returns for TDE participants.

For more information...

Bitcointalk Username: KidsJamanNow

Bitcointalk Profile Link: https://bitcointalk.org/index.php?action=profile;u=1308879