CREDITS Platform is a decentralized financial system for direct interaction between participants of the principle of peer-to-peer (P2P). Credit is the platform (protocol) with the internal crypto currency CREDITS (CS). A unique new technical implementation of the block, intelligent and contract data exchange protocol. It is a platform with technical capability completely new from the network, speed, transaction costs and the number of operations per second. In the open platform, users and companies can create an online service, using a protocol blocking. CREDITS Platform solves the problem of speed and transaction costs and expand the potential for using blocking in the financial industry and the Internet of things.

Choosing CREDITS WHY?

- A very new technology solutions to the problem

- Aimed at a specific target audience finance industry

- Ready MVP prototype project

- Simultaneous processing of up to 1 million transactions per second

- Average operating time is approximately 3 seconds

- Operating costs are very cheap around 0.01%

- Operating costs are affordable micropayments and internet something

- No, working analog in terms of characteristics (in summer 2017)

CURRENT ISSUE

Currently, the network latency is one of the major limitations in many cases the network block. In Bitcoin and Etereum j aringan, the average transaction time over 10

minutes. For comparison, the transaction for credit card payments network took only a few seconds ,

Technical problem

We highlight the following issues: Bandwidth - the network's ability to process a certain number of transactions Latency - the actual response time compared with the expected response time transaction speed. Cost Aparameter for all operationsand in particular for the two groups ofoperation.- Micropayments for the small cost of the transaction - for example, buying coffee, shopping, Microloans

- Internet in terms of operation, for networking different objects. The amount of data stored

This problem prevents the use of the block by many industries and especially by financial companies .

TECHNICAL eXPLANATION

Peer to Peer

Peer-to-peer is a computer network peer-to-peer work through the Internet and using TCP / IP as the transport protocol primary data and commands in the network Pile of the TCP / IP includes four levels: ● The application layer ● transport layer ● ● Internet layer protocol link layer of this level Fully implement the functionality of the OSI model all user interactions in IP networks built on top Stacks TCP / IP protocol. This pile regardless of physical data trans Environment fer, which in particular, ensure communication is completely transparent between wired and wireless networks.Although, technically, it is much easier to create a decentralized financial services rather than creating automated or unmanned vehicles. Environmentally appropriate technologies needed to create a decentralized system of financial products and services based on large books distributed:

- High execution speed (in seconds), along with the ability to handle a large number of transactions simultaneously (hundreds of thousands per second) at a low cost per transaction (for micro-payments and non-cash transactions).

- Developing a system where all participants and goods required for qualitative service financial decentralization combined: user personalization, KYC, bureau credit history, the central settlement of fiat money, withdrawal and disbursement crypto, etc. These are two huge task and fundamental that currently hamper the development of peer-to -peer. financial products We present a solution for this task, we apply it with the help CREDIT financial system. CREDIT decentralized single technology platform can combine all of the participants of financial services, safely and quickly carry out all transactions by using the principles of great books distributed. Intelligent contracts run itself and the principles of the federative voting system provides unlimited opportunity for all participants to create a unique interaction of various financial products. This platform opens a huge new market and new potential projects and services for use roadblock in the financial sector and other sectors that previously could not be used because of limited costs and transaction costs.

Internet layer

Originally designed to transfer data from one network to another. IP network packets containing code Shows the next layer protocol that will be used to extract data from packets Value is a unique IP number of the protocol.Transportasi Layer

Transport layer protocols can troubleshoot message delivery is not guaranteed ( "whether the reach of the message is reached? Recipient address?"), And also ensures the correct sequence of data arrival. In the pile of TCP / IP, transport protocol determines which application is meant by this data. TCP (IP identifier 6) is a "guarantee" a transport mechanism with a connection that is already established, which provides applications with a reliable data stream that gives confidence in the accuracy of the data received, the request data in the event los s, and eliminate duplicate data. TCP regulate network load, while reducing the waiting time for data transmission within jauh.Selain, TCP ensures that the data received has been there delivered exactly in the same order.application Layer

This layer provides data exchange between network software.The concept of DHT (distributed hash table) is used

for constant and stable connection between nodes. DHT is a distributed system class search engine that operates as a distributed hash table data structure, hash tables can be an associative array containing pairs (key-value) .Also, term DHT refers to a number of principles and algorithms that enable the writing of data by distributing information among a set of specific storage node, and recovery

Smart Contract

Preliminary Contract CREDITS system is smart in electronic algorithms that describe a set of conditions in which the actions and events in the real world or a digital system can be linked. To apply smart self-controllable contracts, decentralized environment that is completely excluding the human factor that is necessary, and to use smart transfer contract fee, required crypto-kurrensiur from the central authorities.Smart contract in CREDIT consists of the following entities:

- The property (public variables) - entities that store public data systems necessary for employment contracts in the system CREDIT.

- CREDITS system method is the entity responsible for observing the logic and sequence of actions when conducting a transaction (action based on contract). Participants in the system signed a contract CREDIT intelligently using the call method

Ledger

Ledger The general ledger is a system for storing transaction data (action) performed on systems made in the accounting system account (value). The ledger is presented in dictionary form Key = Value, where Key is given a unique value in the entry when registering in the system; Value is the content of transactions to take action in the system. A pool of transactions that are formed from the transaction approved at the stage of voting nodes are added to the package deals are a list of approved transactions are presented in the format of the dynamic dictionary. Local big book stored on a local disk in a compressed format (archive), created by the compression algorithm called Deflate lossless. Deflate is a lossless compression algorithm that uses a combination of LZ77 And Huffman

Transaction

Transactions Transactions are the minimum unit of a system that informs the execution platformcontract method or a direct transfer between accounts without making a smart contract, followed by the placement of the results in peer-to-peer. After generations, the transaction signed with PrivateKey (ecdsa25519 algorithm described in the security) , encrypted using an encryption algorithm homomorfik (algorithms described in the security) and sent Ke network for further processing. After the transaction enters the network, its hash is generated by an algorithm Blake2s (described above) ..

ADVANTAGES CREDITS

New platform

We offer a product that is completely new to the user. These features are achieved through a new algorithm to seek consensus, a new scheme of operations archiving, processing and

transaction savings, based on algorithms for solving finite state machine that uses a model voting node federative Platform CREDITS dirancan not only for the financial industry. However, financial operations were the main consumers of technology blockchain and are now demanding a product that is able to perform all the tasks assigned to the business and the users.

factors CREDITS

We work to achieve the new parameters of the network is very different from the existing platform Bitcoin and Ethereum . These factors show how CREDITS different from the others. One is the speed factor of up to 100,000 times faster and cost factors of up to 10,000 times cheaper.TECHNOLOGY CREDITS

Homomorfic Encryption

Allows reducing the processing time of the transaction by not having to actually decrypt the data packet. At the same time, confidentiality remains high Hacking and changes significantly more time than voting for the transaction and subsequent placement on the registry.

system Balance

CREDITS is a technology complex software developed by CREDITS.COM PTE. LTD team. Thanks to a thorough analysis of the requirement, we are developing a unique and balanced system to achieve high speed processing speed operation when keeping blockchain system principles and the most stringent security requirements.

Security

We put network security at the forefront. We use an appropriate scheme of network operation, the experience and all the latest advancements in the field of encryption

No Mining

Transactions are transferred centrally for processing to the main node, where they are processed and written to the registry It reduces the time of the transaction process node owner receives 50% commission.

Short Time To Find Consensus

A new consensus principle - with a time interval of 0.01 to 0.5 seconds. The one that computes the function faster, who has a server higher performance and network quality is better - to win in a competition for the right to knot the main network is calculated on the basis of the load and the number of nodes in the network, the more nodes the higher the speed and shorten the time to reach a consensus. And users get 50% commission.

Archiving

Compress the information of up to 90% allows both to reduce the time to load the data, and also saves space servers are used for storage in the network node.

Blockchain / Structure Registry

Collection of data and transactions are stored in the registry that has a serial number and a hash on the node's processing time All verified transaction is loaded into the main node, and a list of candidates from which registers are formed is compiled

Asynchronus job Consensus

Asynchronous work of consensus is parallel processing and building a white list of transactions After the new node processing appears (registered) network, all newly loaded transaction is selected from the list of candidates compiled and white lists starting signal is also sent to the network to the remaining nodes in early stage new consensus.

Not Merkle Trees

Merkle tree is an algorithm (function) to locate a unique file identifier recommend using another function more quickly to find the last saved registry .

CREDITS CRYPTOCURRENCY

Payment For Use

There is little point platform in addition to the data read Paid Users have to pay a certain price in the internal currency (CREDITS). Only then you can create, execute a contract clever and save the information blocked or perform operations CREDITS currency. Also, CREDITS cryptocurrency can be used as a stand- unit of the currency itself outside the platform.

examples of Use

- Payment for the creation of smart contract

- Conduct operations with smart contract

- Adding information about the operation to blockchain

- Payment for the transfer CREDITS crypto among participants platforms

- Purchase information from the source of third-party services in the system (use

- prophecy)

- For operation in the exchange of different currencies in the system

- The transfer fee tokens made in platform CREDITS ,

emissions Coins

The platform does not provide coins mining. There are no additional emission of CREDITS kriptocurrency will be provided Emissions will primary be produced only for the initial sale as part of the ICO. In the future, the token of a standard ERC 20 will be exchanged with CREDITS owned kriptocurrency.

SECURITY CREDITS

Here's how consolidation to improve security.Homomorfic Encryption

Use of homomorfis encryption allows us to work with encrypted questions at all steps of iteration steps (rank).

Hash Search

At the start of the generation and addition of a new pool for the transaction registry, hash (checksum) analyzed relevance to the registry stored locally - as a way of identifying the nodes that are not trusted.

Hash VALUE

Use of Blakes is faster and function crypto stable to get the hash value for the parameter sought.

Decision-making

Use the decision federative principle for additional transactions - as a way to verify the validity of transactions and minimize the possibility of unauthorized transactions.

C ++

Ignore the use of third-party framework, this allows full control of memory and executable code; I increase the durability of code injections and minimize the possible impact of the memory as everything is stored on the heap.

Archiving algorithm

The use of "deflate" modified compression algorithm is how to make it more complex to get a clean registry to introduce a change.

Values

Selection of nodes and the assignment of rank values - is a way to avoid unauthorized environment for the primary node.

Node Selection

Each node can be a play or a knot reliable no more than once within a time interval depending on the network complexity, which eliminates the possibility of the transaction process centralization.

Ownership decentralization

The ability to continue to increase the number of nodes is how to minimize the centralization of ownership of processing facilities.

Big Team

CEO & Founder

Igor Chugunov

12 years in the business, including IT fintech project, e-services and credit bank, affiliate marketing company for banks and companies PDL. Two years of experience with business blockchain. Working with CREDIT platform since 2016.

Evgeny Butyaev

Engineers (software development). More than 10 ten years of software development experience, more than 3 three years of experience with technology blockchain, including SRI Infotech (Poland); blockchain technology-based solutions engineers in Russia. Working at CREDITS platform since 2016.

Team leader

Team leader

Valentin Antonov

Education: Programmer. Experience: more than 10 years as a programmer and architect building a complex and laden system for financial and banking sector. Blockchain in the industry for about 2 years. Qualified in Ethereum platform.

Senior Software Developer

aleksandr Krasnov

A great development experience, including experience in the team blockchain technology safe for US companies StateStreet. Development of engineered solutions for a range of clients and work on high-load system is loaded to society together are based in Europe and the United States.

Community bounty manager

Evgeny Romanov

Plan and conduct marketing and public relations activities online community management company in the social network. In the project responsible for developing and supporting a team of bounty program. Listening Blockchain, 2014.

Head of investment relations department

David Kolmakhidze

Six years of experience in crypto investment, development, consulting projects blockchain. ICO markets strategist. A great experience in building partnerships with investors and angel investors.

PR manager

Elena Matushkina

Seven years of experience in PR. Promote the brand and products in print and online. Participate in the development of a strategy to establish a presence on the social networking client; he continued to work on the conceptual development of the strategy.

Development manager

Bruce Sadia

He is responsible for communicating with partners and foreign organizations. He holds a Masters degree in Communications and PR International. He has three years' experience in the IT sector to communicate with foreign clients.

ADVISOR

ICO

Interest ICO

We did ICO for further development, maintenance and promotion platform CREDITS. The number of token sales will be spent for the following purposes:

- Software development for Platform blockchain CREDITS by contract clever and kriptocurrenc.

- For general administration, operations, capital, marketing and other costs of platform activity operator.

- Funds to support projects created in CREDITS kriptocurrency and platforms CREDITS.

Tokens To ICO

ICO will be based on Ethereum platform in a standard ERC20. CREDITS token after the ICO will be placed on the stock exchange in accordance with the road map in November 2017.

Date ICO

To immediately start the design and development of projects that we propose to spend up to 2 rounds of ICO. PRE-ICO - October 2017 ICO Round 1 - Nov-Des 2017 ICO Round 2 - 2Q2018

The total is 1,000,000,000 tokens.

Total sales expected token to remember a few rounds is 200,000 ETH in several rounds of ICO.

Tokens are not sold will be burned.

DISTRIBUTION TOKEN

The total amount of 100%

- Bounty 2%

- Gift bug 2%

- Founder 15%

- Operating 5%

- Adviser 1%

- Pre-ICO and ICO 75%

After the release of the Beta platform version, this token ERC20 will be replaced with cryptocurrency CREDITS.

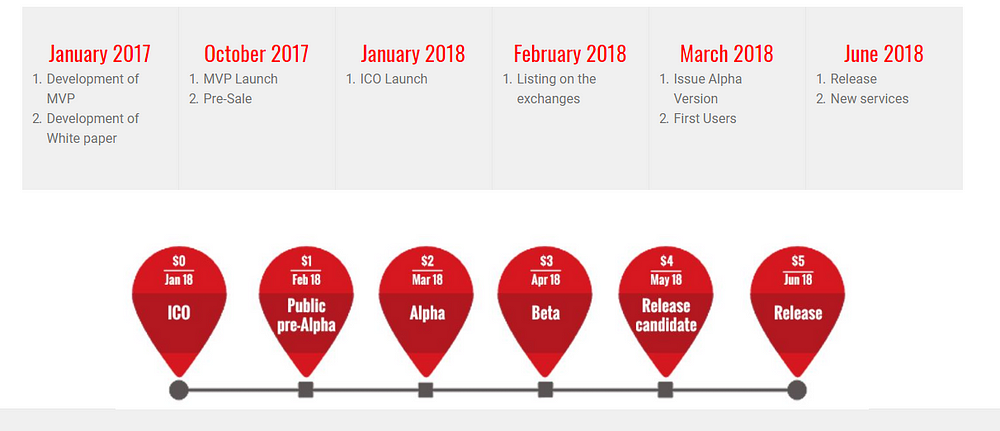

RoadMap

SHORT-TERM PLAN

Project creator

We started working on this project in 2016 with an effort to create a single CREDITS crypto crypto description. Final Draft technical project was formed when we face demand solutions blockchain of the financial sector, but with a number of limitations of existing platforms such as the high cost and low speed transaction. In 2016, a full work on the project began with the elaboration of concepts and terms of reference.

Here's a road map CREDITS platform project implementation in the short to 9 months. Currently, we have developed the MVP projects and is currently working on the Alpha version. After the ICO, the development team will be expanded significantly and we Alpha will release a version for public testing in 4 months.

LONG-TERM PLAN

Interest Strategy

We believe the financial sector is moving forward

decentralization. Kriptocurrency role and

decentralized services will grow exponentially:

- Achieving the number of users who created the platform for 1 million in 3 years. Based on the $ 50 USD as the acquisition cost of the user (Customer Acquisition Cost).

- CREDIT crypto price increase in as many as 500 times in 3 years.

Long-Term Target

The main goal for the next 3 years are:

- Creating safest, in perfect working platform with the regular release updates.

- Support for users CREDITS create a service and platform blockchain.

- P romosi CREDITS sa cryptococcal as a means of payment outside of the platform.

Please make sure you do not miss one of the best projects ever, invest in https://credits.com/en/home/ico For more information about the project CREDITS, you can visit the link below.

Website: https://credits.com/

Medium: https://medium.com/@credits/

Bitcointalk ANN Thread: https://bitcointalk.org/index.php?topic=2190887/

Twitter: https://twitter.com/CreditsCom

My Bitcointalk Profile Link: https://bitcointalk.org/index.php?action=profile;u=1308879

Tidak ada komentar:

Posting Komentar