Investments in real estate are increasingly in demand, but developers sometimes find some issues to offer investment opportunities to investors.

Equitybase is a commercial ecosystem end-to-end, end-to-end ecosystem for project evaluations, credit rating, liquidity events full of blockchain. Equitybase allows developers and fund managers to offer investment-backed investment opportunities directly to investors around the world.

Share section

Equitybase implements the blockchain and smart contract technology for the world of real estate and real estate investments to solve this problem. BASE is an Ethereal Smart-Contract ecosystem that focuses on building a valid real estate investment platform.

Equitybase will offer an effective and safe investment and investment model worth USD 500 billion in cryptocurrency, in a less stable and growing real estate market, generating rental income, value appreciation and hedging.

Participants from around the world will be able to take advantage of our platform to invest and diversify their portfolios, together with the liquidity of the public market, but to profit from the private market.

Supported by our experts with solid experience and reputation in the real estate development, consumer electronics and technology sectors, we at Equitybase have raised seeds for $ 300,000. We have established and out of high profile online companies simultaneously with extensive real estate experience and operational startup for more than 15 years.

In the fall of 2018, the iOS and Android apps are also available to users on our platform, with all the features of our website securely on their mobile devices.

Better returns, lower risk

See the risk and return rates of all major asset classes over the past two decades

The simple solution offered by Equitybase is to offer everyone the opportunity to invest directly in high-quality commercial real estate, with liquidity and income from combined private equity investments without a lock-in period and without intermediaries.

The Equitybase platform will leverage the hybrid market system that allows the restoration of a high annual private market system in tandem with the liquidity of the public market.

Overview Block and Smart Contract

chain lock

Blockchain is the leading, decentralized, public or private digital ledger of all cryptocurrency transactions. Originally developed as an accounting method for the Bitcoin virtual currency, blockchains - which use what is known as distributed ledger technology (DLP) - appear today in a variety of commercial applications. A block is a "stream" section of blockchain, which records part or all of the last transaction. Once done, the block enters the blockchain as a permanent database. Blockchain is designed in such a way that the transaction does not change, which means that it can not be canceled.The blocks are added by encryption, ensuring that they continue to present evidence: the data can be distributed but not copied.

Smart contract

The smart contract, also known as a cryptographic contract, is a computer program that directly controls the transfer of digital currency or assets between the parties under certain conditions. Smart contracts are complicated and their potential exceeds simple transfers of assets: they can be traded in various fields, from legal proceedings to insurance premiums, to monetary agreements with financial derivatives. Smart contracts have the potential to be impartial in the field of law and finance; in particular, by simplifying and automating the routine and repetitive processes that people currently pay considerable legal and banking costs.

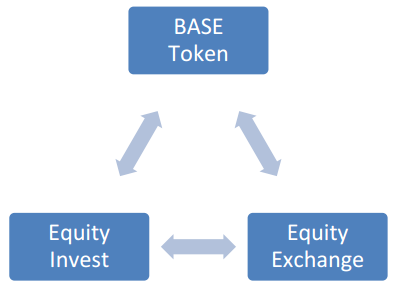

Token BASE

Our platform is based on 2 unit values

BASE tokens, which can be stored in the Ethereal smart / cool portfolio, are ERC20-based blockchain tokens with vesting functions. BASE tokens are built on token sales supported by smart contracts and will be fixed based on volume, stored in any Etherealum ERC20 base portfolio. The equity platform does not hold investors for the minimum investment or holding period.

BASE token growth strategy

To provide greater growth to the platform, the company will introduce a BASE token ordered 6 months after a key period has expired, we will implement a well-executed strategy to maintain a stable token price.

The Equitybase hybrid market platform will offer a simple, transparent and direct property investment. It eliminates the uncertainties typically faced by individual investors and allows almost everyone to build real estate portfolios that provide predictable and consistent results without a lock-in period. Project sponsors and developers worldwide can also take advantage of our platform with the same functionality.

Equity investments

Equity Invest will be based on smart Etherum contracts that represent the acquisition of property (we call it REAL Offers or REO). All returns are based on the recommended waiting period for each specific transaction.

REO ID and type of offer

Amount of funds

Suggest a durable period

Annual interest rates, IRR objectives, multiple equity objectives

A real estate offer or REO will represent the shares on each property. Each investor will be able to exchange or liquidate his ownership of the real estate investment through our equity exchange platform. REO can also be traded on the stock exchange platform. Thus, each investor will be able to transfer and sell his investment to obtain liquidity. The holders of REO will automatically receive a major investment plus ETHER which corresponds to the sale gain of the property.

bag

Equity Exchange allows the purchase and sale of real estate or real estate funds similar to the stock market without a lock-in period.

Equity in backup

Equity Reserve issue as a secondary backup operator that provides an additional level of liquidity in the Exchange equity platform, will be used as a reserve to allow users of the continuous platform with guaranteed liquidate their holdings in the repurchase of the shares.

Equitybase APP

Equitybase app connects users to blockchain using smart contract, users will be able to access their assets and information investments, the value of which is entered in the general accounting blockchain.

Investment stack

This type of investment describes the relationship between equity and debt. The lower the lower level, the lower the risk for capital and vice versa when rising higher.

The capital structure represents all types of capital invested in real estate and the relationships between each category.

investment

Equity: represents the ownership of the activities.

Debt: loans are granted to shareholders and are usually guaranteed by the asset itself or by other activities of the owner.

debt

The debt always falls in the mass of capital and is therefore older than the capital, which means that it is repaid first. Much of the real estate debt is given by traditional lenders, such as banks, which take on senior secured positions.

Equity Together

Equity investors, unlike debt, participate in successful investments, which means that their increase or potential return is not limited, but may increase or decrease based on the return on investment.

Preferred equity

As a hybrid structure, this type of investment is older than traditional equity investments but under debt. Often the yield structure is also a hybrid between equity and real debt, where a mezzanine / preferential equity investor receives a fixed return on investment for a given investment period but can potentially participate in an increase or continued success of the investment. .

Equity fund

The Equity Fund mission will acquire, develop and manage commercial real estate activities through: careful selection, care, value investment and impeccable portfolio management. Equitybase will mainly focus on intermediate assets between $ 5-100 million USD.

We use value-added investment strategies; value added investments tend to produce higher long-term returns than real estate values together with passive income. By carefully selecting a real estate portfolio, the equity fund intends to generate long-term value and income. The equity fund aims to achieve a competitive purchase price and offers leasing and repositioning of tailor-made assets.

focus:

Application of diversified portfolios of high quality commercial real estate that translate into high rates of return on residual and capital income.

Identify value-added investment opportunities and projects to generate temporary fixed income, while higher returns after completion of restructuring.

The investment analysis aims to generate greater value by focusing on quality assets in privileged positions that have the potential to generate stable and sustainable cash flows.

Reconstruct urbanization property in a viable commercial or mixed project to generate substantial profits for its participants.

We will mainly focus on the development of added value and land development in targeted cities.

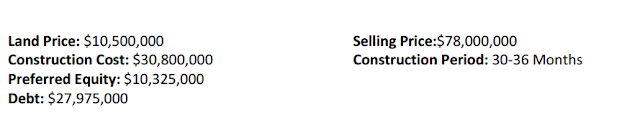

example

TYPE Investment: added value

Office buildings with external and internal updates

Square feet: 83.252 sqm / 7.734m²

Net profit after the capital

TYPE: development

Development of a mixed use of 120 residential units with 20,000 m² retail

Piazza Feet: 130.000 m² / 12.077m²

Net profit after the capital

Investment position

Our main investment objective is to focus on super cities like New York, Los Angeles and expand into other markets like Hong Kong and London in the near future. Each of these markets benefits from the following positive trends:

Coherent growth rate

It stabilizes value

High request

Excess of downside risk

Ease of capital increase

Piattaforma Equity Platform Technology

The Equitybase platform is a self-contained P2P protocol network protocol for digitizing buildings in a decentralized system. We have designed a powerful DAPP for desktop and mobile apps that allows all users to interact with their properties on the platform and also to the sponsors and developers to list and update the status of their properties.

The software component of the equitybase platform uses the following technologies:

Equity revenues

Equitybase will earn up to 2% of net revenues from general income and 2% + of capital events. Equitybase will charge a 1% commission for a list of real estate developer platforms and sponsors interested in registering their potential properties on our platform. Investors and sponsors can deduct or fully exempt the cost by obtaining an equivalent token value equivalent to BASE.

Rental income

The financial flows of the operations are distributed in the following order:

Payment of senior debt service

Payment of the current made preferred by REO

The rest of the proceeds to all shareholders have the same level of agreement

Capital events

Income from capital assets should be distributed in the following order:

Remuneration of the outstanding loan balance

Payment to REO from current unpaid refunds

Payment to REO from the restitution of the options matured

Return the invested capital to REO

The rest of the proceeds to all shareholders have the same level of agreement

Equitybase ICO

BASE: Token EquitybaseERC20

The BASE ICO general token will start on 28/02/2018 and end on 22/05/2018 with an initial discount of 30%, the discount rate will be lower with an increase of 5% each week for the duration of the ICO sale. The minimum contribution during the public ICO will be 0.001 ETH. The transfer rate is set at $ 0.28 / BASE Token.

Distribuzione on token

Total BASE tokens will be set at 360,000,000, where 50% will be sold during ICO, the remaining backup tokens will be kept for 1 year and secretly launched to stimulate platform growth, if necessary. The 20% token will be awarded to the founding team members and their consultants with a 12 month maturity period. 10% of the total token share will be distributed to community marketing programs before and after the ICO process.

Results from ICO

Teams and consultants

Website: https://equitybase.co/

White paper: https://equitybase.co/equitybasewhitepaper1.pdf

Bitcointalk Username: KidsJamanNow

Bitcointalk Profile Link: https://bitcointalk.org/index.php?action=profile;u=1308879

Tidak ada komentar:

Posting Komentar