Society has advanced more in the past several decades than it has in a millennium. Despite all our technological and societal advances, we struggle to overcome some of the same fundamental challenges -global poverty, disease, and the distribution of wealth and power, to name just a few. Humanity has a long way to go. Everyday each one of us is trader consume much of news, chat and other information about the capital market we do this in order to understand what we are investing in, With so much data we can fail to find these business opportunities and the task of researching is very time consuming. The solution to this is Traderiser, instead of disturbing yourself just ask traderiser. With traderiser you can get answer to both simple,complex and news based trading questions. Lets look at the video below...

TRADERISER

TradeRiser is a Research Assistant platform that can answer both simple and news based trading questions. Users can type a trading question into search box and TradeRiser will go to work to compute the answer.

TradeRiser is a Research Assistant platform that can answer both simple and news based trading questions. Users can type a trading question into search box and TradeRiser will go to work to compute the answer.

PROBLEMS

Motivation - Simplifying financial data analytics

The growth of the world wide web led to innovations in search engine technology, this made the web more accessible and ubiquitous. However financial data analytics, has not enjoyed the same the level of simplicity and accessibility seen in the world wide web. The growth of big data cannot be stopped, accessibility and ubiquity presents a huge opportunity, to systems that seek to democratize financial data analytics.

Motivation - Simplifying financial data analytics

The growth of the world wide web led to innovations in search engine technology, this made the web more accessible and ubiquitous. However financial data analytics, has not enjoyed the same the level of simplicity and accessibility seen in the world wide web. The growth of big data cannot be stopped, accessibility and ubiquity presents a huge opportunity, to systems that seek to democratize financial data analytics.

Disrupting Human Intensive Research

Research is normally time consuming, inefficient, prone to information overload and requires a lot of manpower. Financial professionals worldwide spend a lot of time and money in research trying to answer these trading questions.

Research is normally time consuming, inefficient, prone to information overload and requires a lot of manpower. Financial professionals worldwide spend a lot of time and money in research trying to answer these trading questions.

Fewer Ideas Are Tested

Current platforms rely on a great degree of technical know how to test trading ideas, and due to the barriers to entry fewer trading ideas are tested. Every day a portfolio manager has an investment idea and has to go to a quant to build the model.

Current platforms rely on a great degree of technical know how to test trading ideas, and due to the barriers to entry fewer trading ideas are tested. Every day a portfolio manager has an investment idea and has to go to a quant to build the model.

Time-Consuming

Quantitative research can be an incredibly time consuming process, as it requires multiple steps in order to be completed, sometimes spanning across several days and hours. Other bottlenecks include the computational process due to the amount of data being analyzed.

Quantitative research can be an incredibly time consuming process, as it requires multiple steps in order to be completed, sometimes spanning across several days and hours. Other bottlenecks include the computational process due to the amount of data being analyzed.

Inefficiency

The research process requires the data gathering, data cleaning and data analyses, and the final step being report creation. This is an incredibly an inefficient process.

The research process requires the data gathering, data cleaning and data analyses, and the final step being report creation. This is an incredibly an inefficient process.

Information Overload

With data being the new “oil” or a valuable resource, the job of analysts is all the more difficult in trying to process data. New avenues of data are constantly creeping up which can potentially be exploited in financial research, especially unstructured data.

With data being the new “oil” or a valuable resource, the job of analysts is all the more difficult in trying to process data. New avenues of data are constantly creeping up which can potentially be exploited in financial research, especially unstructured data.

News and Events - Unstructured Data

It is well known that the news and world events have impact on the financial markets, it is for this reason that tools such as the economic and earnings report calendars were created. These tools allow traders to keep up and monitor impactful events, however there is a whole basket of world events that have not be organised to be included in a calendar, that needs to be structured. As it stands traders struggle to keep up or hedge against data from sources such as twitter, cryptocurrency news, weather data and even satellite data.

It is well known that the news and world events have impact on the financial markets, it is for this reason that tools such as the economic and earnings report calendars were created. These tools allow traders to keep up and monitor impactful events, however there is a whole basket of world events that have not be organised to be included in a calendar, that needs to be structured. As it stands traders struggle to keep up or hedge against data from sources such as twitter, cryptocurrency news, weather data and even satellite data.

SOLUTION

TradeRiser solves these problems through its Research Assistant that can immediately answer trading questions that a trader or investor has about the financial markets. TradeRiser’s token mechanism will keep track and compensate financial analysts for their datasets of questions, data validation, accuracy checking, suggestions and example

report creation. The financial analysts can contribute in these ways to help train our machine learning Research Assistant, and be compensated accordingly. XTI is the underlying mechanism used to facilitate this ecosystem, and provides XTI holders with direct participation in advancing our “single source of truth” questioning and answering system

TradeRiser solves these problems through its Research Assistant that can immediately answer trading questions that a trader or investor has about the financial markets. TradeRiser’s token mechanism will keep track and compensate financial analysts for their datasets of questions, data validation, accuracy checking, suggestions and example

report creation. The financial analysts can contribute in these ways to help train our machine learning Research Assistant, and be compensated accordingly. XTI is the underlying mechanism used to facilitate this ecosystem, and provides XTI holders with direct participation in advancing our “single source of truth” questioning and answering system

FEATURES

Community Edition :- This is comprised of many features that will be available to the community. They are as follows, the Research Assistant powered by the community data feed, ICO ratings, market condition analysis, ICO due diligence, investor portfolio analysis, direct trading, web and mobile app.

Research Marketplace :- Accessible to Token holders

Enterprise Edition :- This standalone version is accessible to financial institutions,

hedge funds or corporations. This includes our API.

Community Edition :- This is comprised of many features that will be available to the community. They are as follows, the Research Assistant powered by the community data feed, ICO ratings, market condition analysis, ICO due diligence, investor portfolio analysis, direct trading, web and mobile app.

Research Marketplace :- Accessible to Token holders

Enterprise Edition :- This standalone version is accessible to financial institutions,

hedge funds or corporations. This includes our API.

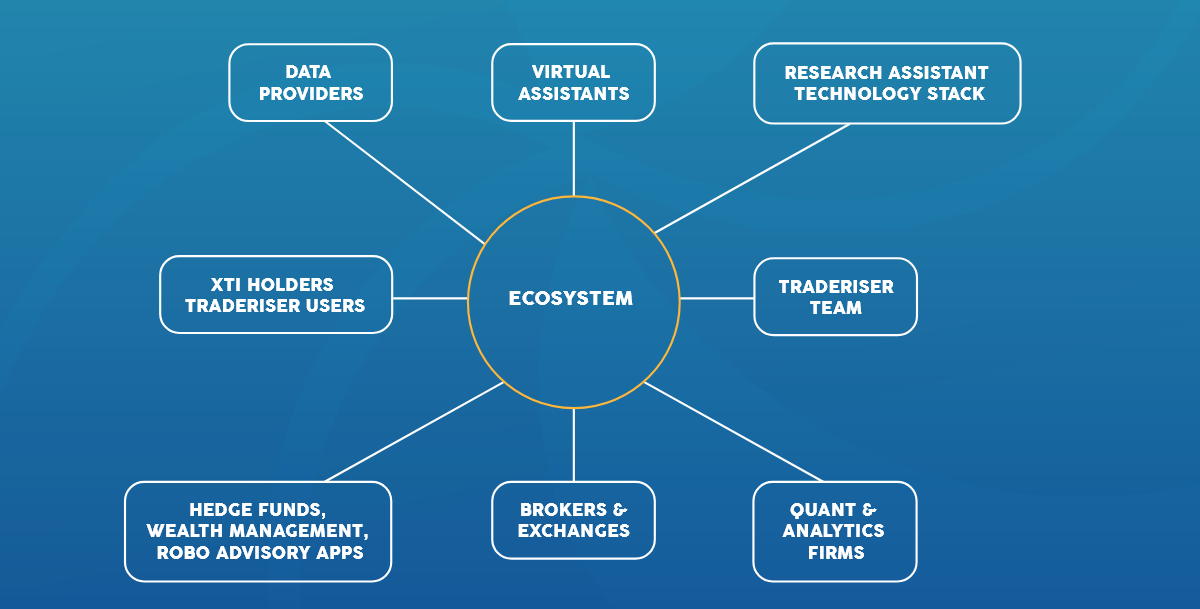

ECOSYSTEM

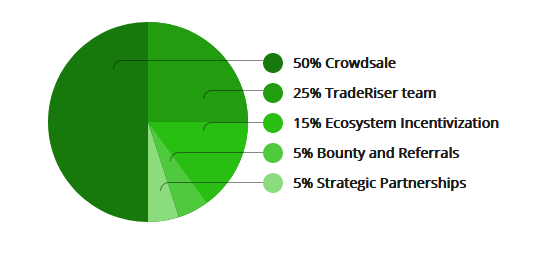

TOKEN DISTRIBUTION

50% Crowdsale

15% Distributed to Community for Ecosystem Incentivization

25% Company founders, advisors and employees

5% Bounty and Referrals

5% Strategic Partnerships and Future Development

15% Distributed to Community for Ecosystem Incentivization

25% Company founders, advisors and employees

5% Bounty and Referrals

5% Strategic Partnerships and Future Development

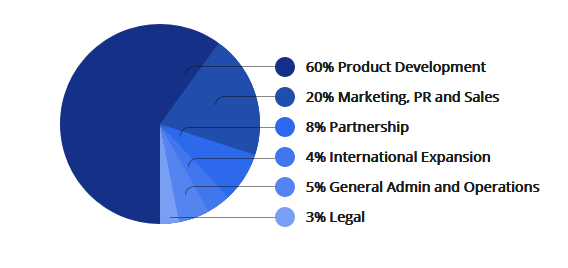

FUND DISTRIBUTION

60% Product Development

20% Marketing, PR and Sales

8% Partnership

4% International Expansion

5% General Admin and Operations

3% Legal

20% Marketing, PR and Sales

8% Partnership

4% International Expansion

5% General Admin and Operations

3% Legal

Target on crowdsale: $23,000,000

Total in existence: 500,000,000 XTI

XTI Token type: ERC20

Purchase methods accepted: BTC and ETH

Based on Ethereum blockchain and the Ethereum smart contract

Employee allocation of XTI will have a vesting period of 24 months, with a 6 month cliff.

Allocation will be proportional to the tenure of each employee by the date of token sale.

Unsold tokens will be burnt.

Total in existence: 500,000,000 XTI

XTI Token type: ERC20

Purchase methods accepted: BTC and ETH

Based on Ethereum blockchain and the Ethereum smart contract

Employee allocation of XTI will have a vesting period of 24 months, with a 6 month cliff.

Allocation will be proportional to the tenure of each employee by the date of token sale.

Unsold tokens will be burnt.

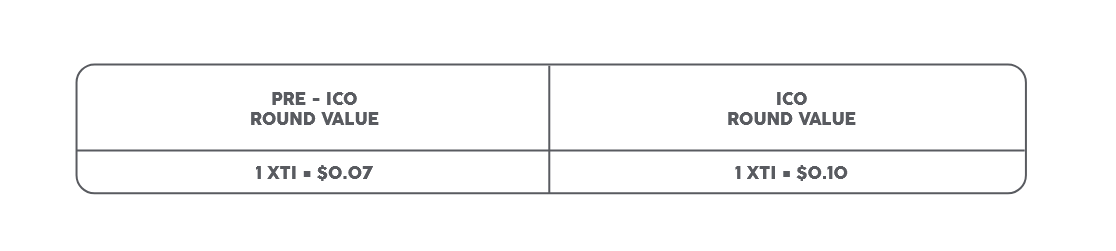

PRE – ICO

ROUND VALUE

1 XTI = $0.07

ROUND VALUE

1 XTI = $0.07

ICO

ROUND VALUE

1 XTI = $0.10

XTI Supply

XTI will have a supply with nominal value USD 23,000,000.

XTI Refunds

In certain cases, XTI may be refunded to platform participants. For example, use cases may arise that will necessitate a refund, but typically will follow a minimum period of 3 weeks before this takes place.

ROUND VALUE

1 XTI = $0.10

XTI Supply

XTI will have a supply with nominal value USD 23,000,000.

XTI Refunds

In certain cases, XTI may be refunded to platform participants. For example, use cases may arise that will necessitate a refund, but typically will follow a minimum period of 3 weeks before this takes place.

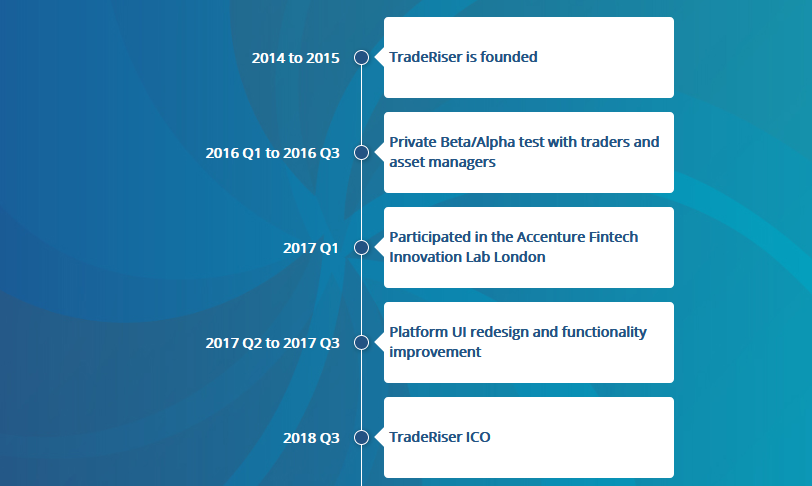

ROADMAP

2014 to 2015

TradeRiser is founded

2016 Q1 to 2016 Q3

Private Beta/Alpha test with traders and asset managers

2017 Q1

Participated in the Accenture Fintech Innovation Lab London

2017 Q2 to 2017 Q3

Platform UI redesign and functionality improvement

2018 Q3

TradeRiser ICO

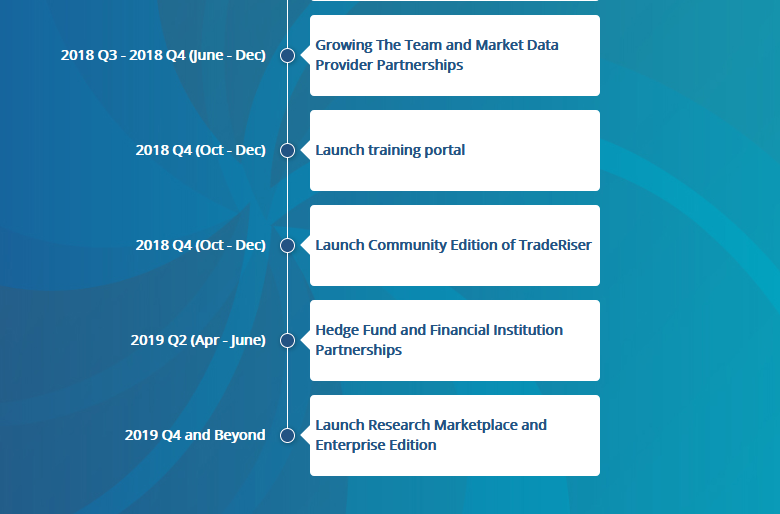

2018 Q3 – 2018 Q4 (June – Dec)

Growing The Team and Market Data Provider Partnerships

2018 Q4 (Oct – Dec)

Launch training portal

2018 Q4 (Oct – Dec)

Launch Community Edition of TradeRiser

2019 Q2 (Apr – June)

Hedge Fund and Financial Institution Partnerships

2019 Q4 and Beyond

Launch Research Marketplace and Enterprise Edition

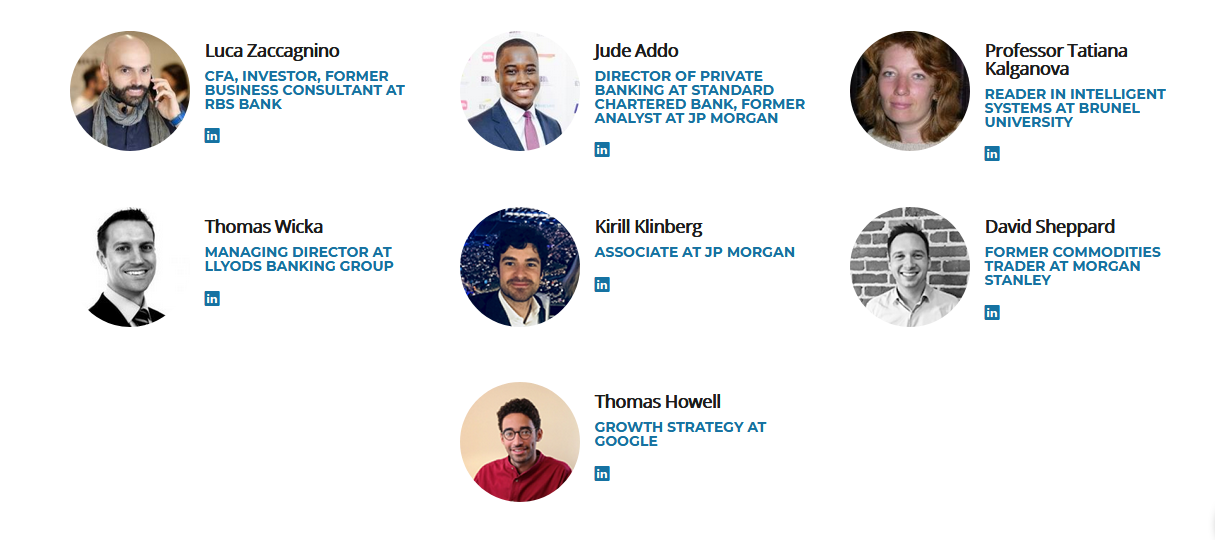

THE TEAM

ADVISOR

For more information, please visit:

Website: https://www.traderiser.com

Twitter: https://twitter.com/TradeRiser

Telegram Group: https://t.me/traderiser

Bitcointalk ANN: https://bitcointalk.org/index.php?topic=3835944.0

Bitcointalk Username: KidsJamanNow

Bitcointalk Profile Link: https://bitcointalk.org/index.php?action=profile;u=1308879

Tidak ada komentar:

Posting Komentar