= About Remiit =

Remiit is a money transfer and billing platform. The Blockchain connects many different companies and users via a contract system based on credentials based on credentials . REMIIT strives to enable business scalability in the money transfer business and offers users an inexpensive and transparent process with value stability through a two-tiered token system. REMIIT wants to create a market and an ecosystem that allows local businesses to grow while offering transparent money transfer to users.

= Remiit as a catalyst for globalization =

REMIIT will create faster and more transparent payment and transfer systems while enabling money transfer operators (MTOs) and financial institutions to create a community of trusted cross-references. prestige

= The platform is based on the blockchain =

The REMIIT Reputation Rating System, which is a major feature of the platform, allows these operators to focus on their money transfer activities with MTOs or other peers and make secure transfers.

The vision of the REMIIT project is to enable MTOs around the world to expand into developed countries and to grow as a reliable money transfer service provider in the market.

= Problem =

They briefly mentioned above that remittances and payment methods available abroad pose many problems. These are real stories related to the current economic and lifestyle structures, considered as problems on which many companies have worked on blockchain-based solutions. The main issues raised are the costly remittances and the slow transaction speed. These companies have proposed different solutions to these problems.

= Reliability and confidentiality issues =

They can not put money on something they can not trust! The most important factor in transfer and settlement is “reliability”. However, the “reliability” of a monopolistic (centralized) system poses many problems.

= Profitable =

In a centralized financial system, costs are only increased because of the monopoly of the market by the limited number of actors. Here, profitability involves not only reasonable prices, but also efficiency.

= Ecological Remiit System =

REMIIT to disrupt the entire global money transfer market in REMIIT blockchain technology called Smart Contract (RSC), algorithms and configuration optimized for money transfer services. In this system, depositors experience transparent process of transfer of funds. In addition, the REMIIT Payment Gateway Protocol (RPGP), the innovative payment systems, will be combined with RSC to extend the service to payment. system based REMIIT Eco System, not only the payment service providers will be able to diversify the business of their business, but the problems will be overcome only the transfer of money and paid earlier.

= Size of the money transfer market =

According to the World Bank, the amount of international remittances in the world in 2016 is about $ 613.3 billion, a growth of 2 to 4% per year. The amount of remittances from the United States exceeds $ 130 billion a year. Secondly, this number is three times higher than that of Saudi Arabia ($ 44 billion), with a large volume of remittances. That’s why Western Union, the largest transfer brokerage company in the world (20% market share) and MoneyGram (5% market share), are located in the United States. At present, money transfer operators such as the current commercial banks, Moneygram and Western Union, occupy the absolute share of the global remittances market, at 94% in 2014.

= Scalability of money transfer business: corporate payments =

Large scale marketing does not just mean “transfer”. Remittances abroad overlap with the overseas payments market, which means that there is an opportunity for business expansion if certain issues are resolved. The following example shows the market for remittances abroad and the payment is closely related.

= Intelligent Contract Remiit =

REMIIT builds its own blockchain smart block framework and provides the REMIIT Smart Contract (RSC) model optimized for offshore remittance service providers. The RSC was created as a result of the REMIIT development team, as well as suggestions and comments from different participants. This will be constantly updated in terms of quantity and quality for different fund transfer mechanisms, such as free and global funding, etc. Easily find the right model for their situation. Specific needs

= Remiit Payment Gateway Protocol =

RSC lay the foundation for a key scalability. The REMIIT Payment Gateway Protocol (RPGP) is designed to accelerate the development of international payment activities and the development of key infrastructure. In addition to direct remittances abroad, foreign exchange transactions must be indirectly related to all enterprises requesting payment abroad. However, foreign exchange transactions are always carried out in a closed system of conventional financial systems. The result has been identified so far, it’s a huge loss for the user and the assignee.

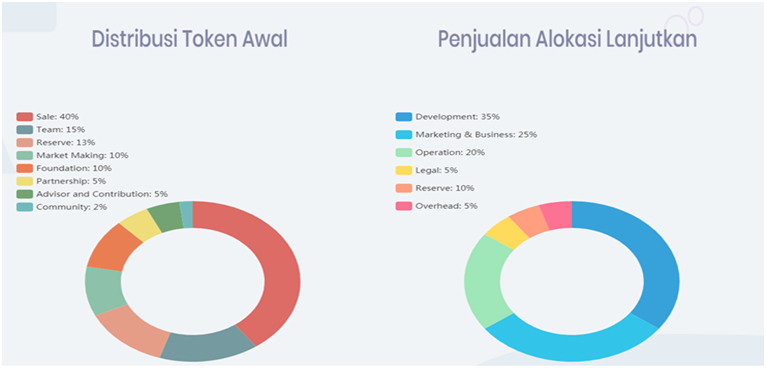

= Distribution of chips and funds =

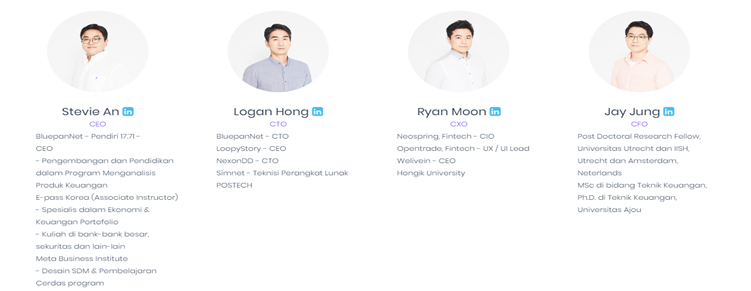

= Team =

= Details :

Website: https://remiit.io/

Facebook: https://www.facebook.com/remiit.io/

Twitter: https://twitter.com/remiit_ico

Telegram: https://t.me/remiit

Bitcointalk Username: KidsJamanNow

Bitcointalk Profile Link: https://bitcointalk.org/index.php?action=profile;u=1308879

Tidak ada komentar:

Posting Komentar